Get Access to Specialist Finance Solutions Tailored to Your Needs

In the world of financing, protecting the appropriate finance can be a pivotal action in the direction of achieving your financial objectives. Remain tuned to discover how tailored loan options can be the secret to opening your economic success.

Recognizing Your Financial Needs

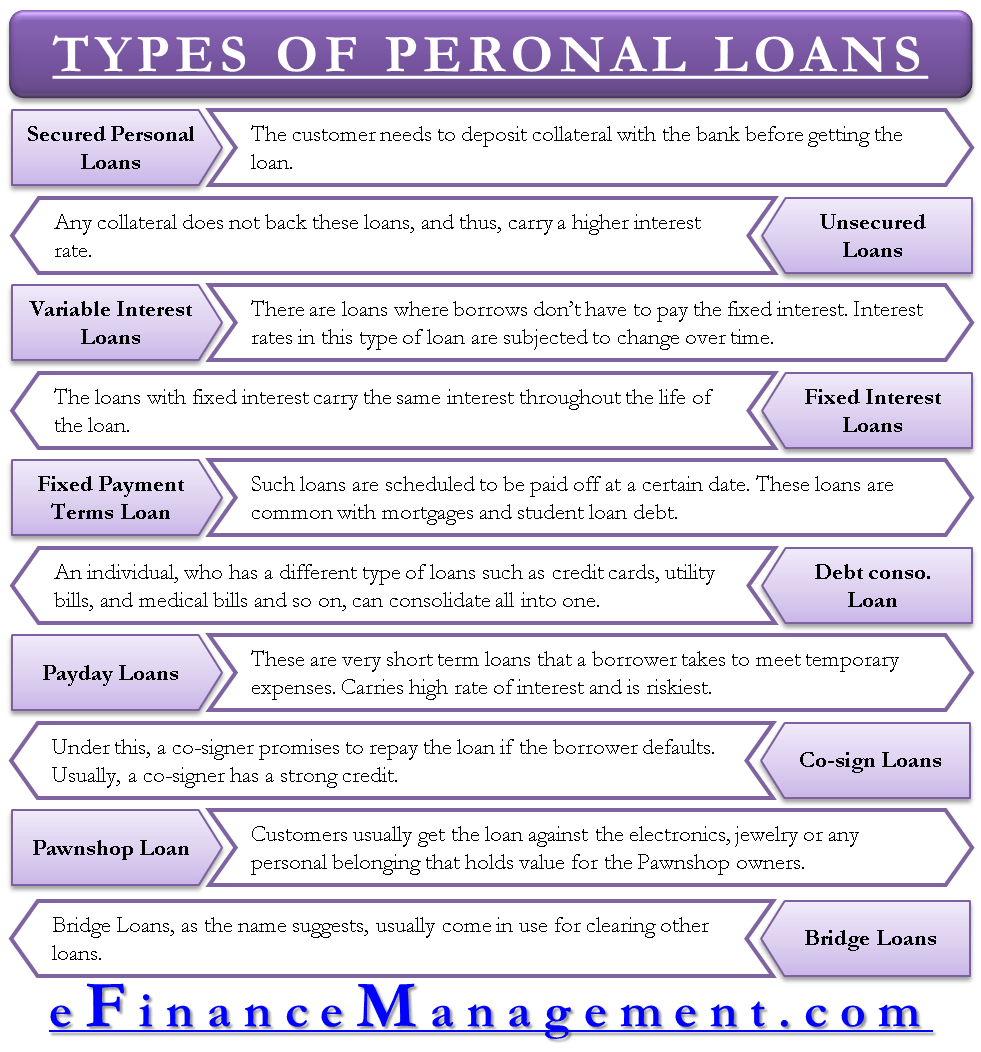

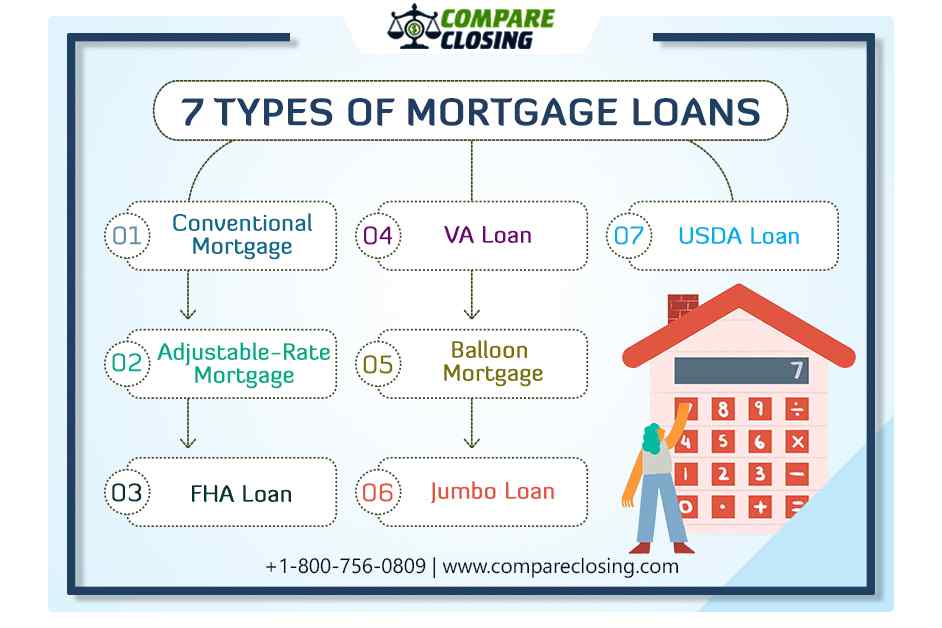

By examining your income, costs, cost savings, and economic objectives, you can produce a clear picture of what you require from funding services. Furthermore, comprehending the numerous types of financings offered and their particular attributes can aid you choose the most suitable choice based on your requirements. By taking the time to review your monetary requirements thoroughly, you can come close to financing solutions with a clear understanding of exactly how they can support your monetary goals and push you towards a safe monetary future.

Discovering the Right Car Loan Options

Evaluating your economic needs is the structure for choosing the most suitable finance alternatives to straighten with your brief and long-lasting monetary goals - loans bc. When it pertains to finding the right finance options, it's crucial to consider numerous aspects such as the function of the funding, the amount required, the payment terms, and your credit reliability

Some financings have minimum and maximum limitations, so make sure the financing amount aligns with your financial needs. Elements such as rate of interest rates, payment periods, and regular monthly installments play a considerable duty in selecting the right car loan option.

Lastly, evaluate your credit report and economic background. Lenders often consider these variables when authorizing finances and figuring out rates of interest. By comprehending your creditworthiness, you can choose loan alternatives that best suit your economic circumstance.

Dealing With Experienced Lending Specialists

Working together with experienced lending professionals can substantially enhance your borrowing experience and monetary results. Experienced lending specialists bring a riches of expertise and knowledge to the table, assisting you with the funding procedure with self-confidence and efficiency. These specialists can use valuable understandings right into the complexities of various funding products, assisting you browse complex financial terms. By working with experienced loan experts, you can gain from their market links and strategic partnerships, possibly accessing to unique lending deals and affordable interest rates.

Personalizing Loan Terms

One means to tailor lending terms is by discussing the financing quantity and passion price with the lender. Consumers ought to strive to secure beneficial terms that align with their ability to repay the funding pleasantly. In addition, reviewing choices such as versatile payment timetables or the possibility of very early settlement scot-free can even more customize the loan to the borrower's details demands.

Moreover, customers should pay very close attention to any kind of extra fees or charges linked with the financing. By tailoring the finance terms to reduce these extra prices, about his debtors can guarantee that they are getting the best feasible offer. Ultimately, tailoring financing conditions can result in a more workable borrowing experience and lead the way for financial success.

Protecting Your Future Financial Goals

To guarantee lasting monetary security, it is vital to align your loaning choices with your future financial objectives after customizing lending conditions to fit your current economic circumstances. Safeguarding your future financial objectives includes mindful preparation and strategic loaning. By considering your lasting objectives when obtaining a financing, you can make certain that your financial decisions today sustain your aspirations for tomorrow.

One secret facet of safeguarding your future financial goals is to pick finance products that use adaptability and workable settlement terms. This allows you to easily fulfill your financial responsibilities while still spending and saving towards your future goals. Furthermore, it is essential to collaborate with economic experts that can provide support on structuring your loaning in a method that aligns with your goals.

Inevitably, safeguarding your future financial objectives through notified borrowing choices sets the structure for long-term monetary success and stability. By being intentional and calculated with your borrowing, you can lead the way for accomplishing your financial aspirations and developing a protected economic future.

Verdict

In conclusion, accessing specialist financing services that are customized to your certain monetary needs is vital in protecting your future economic objectives. By understanding your monetary demands, discovering the best funding alternatives, dealing with skilled financing experts, and tailoring funding terms and conditions, you can make certain that you are making educated decisions that line up with your long-lasting monetary objectives - loan bc. This aggressive method will eventually result in higher economic security and success in the future

Some financings have minimum and optimal limits, so make sure the click here for more info car loan quantity straightens with you can look here your monetary demands. Experienced finance experts bring a wide range of knowledge and know-how to the table, directing you through the funding procedure with self-confidence and effectiveness.In addition, knowledgeable loan professionals have a deep understanding of the ever-evolving monetary landscape, permitting them to tailor loan solutions to your details needs and conditions.One method to personalize finance terms is by bargaining the financing quantity and interest price with the loan provider. By comprehending your financial needs, discovering the right financing options, functioning with seasoned lending specialists, and tailoring funding terms and conditions, you can make sure that you are making notified choices that line up with your lasting monetary goals.

:max_bytes(150000):strip_icc()/three-things-to-do-after-you-pay-a-debt-collection-65e3437ed54146ceb927ff1c1ea4fbf4.png)